Underwriting, the backbone of the insurance industry, has long relied on human expertise to assess risk and make critical decisions. While effective in its time, this approach was slow, labor-intensive, and limited in scope. The demands of a dynamic market and evolving customer needs have made these traditional methods increasingly cumbersome. Today, digital innovation is reshaping underwriting. Technologies like artificial intelligence (AI), machine learning (ML), big data analytics, and blockchain are revolutionizing how insurers assess and manage risk. By automating processes, analyzing diverse diverse datasets, and enhancing accuracy, these advancements are creating a faster, more inclusive, and customer-centric system.

The Technology Driving Change

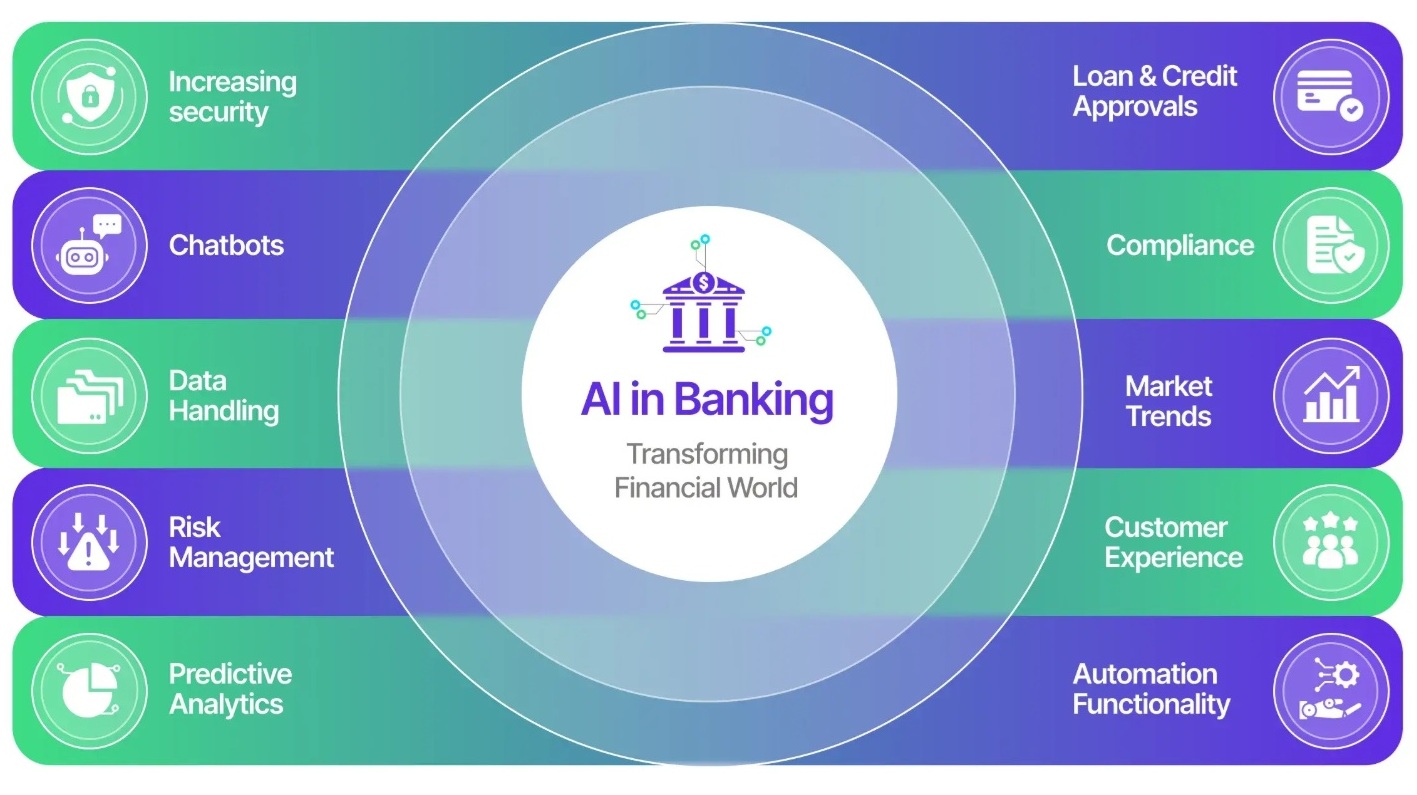

AI and ML have become central to this transformation, enabling insurers to to process vast datasets and uncover insights that humans alone could not achieve. These technologies create highly accurate risk profiles by analyzing both conventional and unconventional data sources, such as social media activity and purchasing patterns.

This has given rise to automated underwriting, where AI handles repetitive tasks like data analysis and risk scoring, freeing underwriters to focus on complex cases requiring human judgment. Personalization has also improved, as AI enables insurers to offer tailored policies with fairer risk rating. Fraud detection has seen significant advancements, with algorithms capable of spotting anomalies and preventing fraudulent claims.

Big data analytics offers insurers deeper insights into customer behavior and risk factors. Predictive analytics uses these insights to anticipate risks and proactively develop mitigation strategies, enhancing the resilience of insurance portfolios.

The Internet of Things (IoT) further broadens underwriting capabilities by generating real-time data about individuals’ health, lifestyle, and behavior. As an example, fitness trackers and applications provide life insurers with insights into health, while telematics devices in cars allow general insurers to offer premiums based on driving habits. These technologies encourage healthier lifestyles and safer practices, benefiting both insurers and customers.

Blockchain technology adds another layer of innovation, offering enhanced security and transparency. Smart contracts streamline claims processing, reducing fraud and expediting payouts. Blockchain also facilitates secure data sharing among stakeholders, improving collaboration and efficiency across the insurance ecosystem.

Transforming the Underwriting Landscape

The benefits of these technologies are immense. Automation has drastically reduced processing times, while data-driven insights have improved risk assessments and pricing accuracy.

Perhaps the most significant impact is the promotion of financial inclusion. By using alternative data sources, insurers can fairly assess populations traditionally excluded due to limited financial histories. This opens access to essential financial products for underserved groups, fostering greater economic equity.

However, challenges remain. Data privacy and security are critical concerns, as insurers handle sensitive customer information. The potential for bias in AI systems is another pressing issue; algorithms trained on historical data risk perpetuating existing inequities. Addressing these challenges requires rigorous oversight, continuous refinement, and collaboration across the industry. Regulatory frameworks must also evolve to keep pace with innovation, ensuring that technological advancements align with consumer protection.

A New Vision for Underwriting

The future of underwriting lies in harmonizing human expertise with technological innovation. While machines excel at processing data and identifying patterns, underwriters will continue to play a vital role in navigating complex cases and fostering trust. This partnership will drive unprecedented levels of accuracy, efficiency, and personalization.

Looking ahead, broader adoption of AI and ML can enable hyper-personalized products tailored to individual needs. IoT devices will seamlessly integrate into risk models, shifting the focus from reactive risk management to proactive prevention. The industry will evolve from merely assessing risk to actively helping customers avoid it altogether.

This transformation is more than a technological evolution; it marks a fundamental shift in how insurers view and serve their customers. By embracing innovation while addressing ethical and regulatory challenges, the industry has an opportunity to redefine underwriting as a tool for empowerment and equity.

Underwriting’s role will expand far beyond risk assessment — it will enable dreams, foster inclusion, and build a stronger foundation for the future. With the right balance of technology and empathy, the promise of this new era can be fully realized.

Author: Akshay Dhand, Actuary of Canara HSBC Life Insurance

Source: ETCISO, 5th Feb 2025