Risk Management & GRC

A new career opportunity is on the horizon!

Practice Overview

Our practice focus on hiring visionary leadership, encompassing diverse risk categories across industries. Our approach offers

industry-agnostic solutions, employs cutting-edge techniques, leverages exclusive data, and relies on in-depth industry

knowledge and a robust professional network. This comprehensive strategy positions usto navigate complex risks while aligning

with long-term client goals. Utilizing our proprietary data platform and search methodologies, we assist in identifying the

right leaders for the organisation’s business needs.

- Our Risk Management practice operates cohesively with a strategic focus on hiring executive talent and transformative leaders across regulatory roles and various business risk areas, including Financial, Geopolitical, Technology, and ESG,spanning GIC sectors.

- Our accomplishments are steered by profound industry acumen and an extensive network of professionals in the realm of Risk Management and Compliance.

- Our Risk Management practice operates cohesively with a strategic focus on hiring executive talent and transformative leaders across regulatory roles and various business risk areas, including Financial, Geopolitical, Technology, and ESG,spanning GIC sectors.

- Our accomplishments are steered by profound industry acumen and an extensive network of professionals in the realm of Risk Management and Compliance.

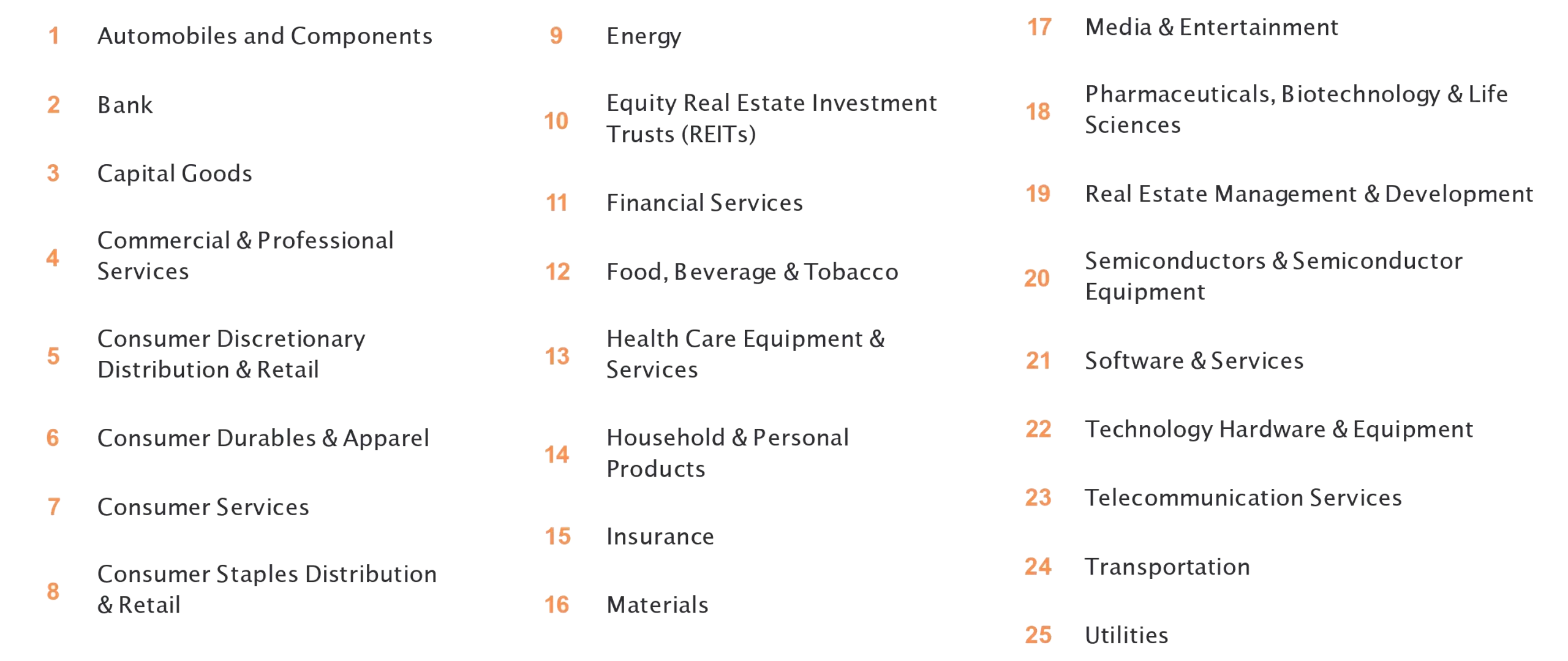

Areas of Focus: GICS – Industry Groups

Global Industry Classification Standard is a globally recognized system for categorizing industries, facilitating precise analysis and investment decisions.

Hiring Areas of Focus

Risk Management & GRC

- Enterprise Risk

- Credit Risk & Underwriting

- Fraud Risk

- Financial Risk

- IT Risk / Cybersecurity / Info Sec

- Risk Analytics

- Model Risk Management (MRM)

- Risk Ratings

- Risk & Research Solutions / Consulting

- Catastrophic – Risk / Perils / Modeling

- Compliance Functions

- Audit Functions

- GRC Technology

- Supervisory Technology (SupTech)

- Regulatory Technology (RegTech)

- Data Governance

- Re-Insurance

- Actuary / Actuarial Science

Typical Positions

Risk Management & GRC - Typical Positions

- Chief Risk Officer

- Chief Compliance Officer

- Chief Credit Officer

- Partner – Governance, Risk and Compliance

- Advisor – Compliance

- Global Head – Model Risk Management

- VP – Technology Risk

- Head – Credit Risk

- Head – Enterprise Risk Management

- Head – Financial Risk

- Head – Operational Risk & Internal Controls

- Head – Market Risk

- Head – Data Governance

- Head – Counterparty Risk

- Director / Head – Risk Analytics & Modeling

- Director / Head – Cybersecurity

Regulatory Guidelines

We have a well-defined and systematic approach towards executive search. Our team of dedicated consultants have rich experience in appointing executives in regulatory functions across various industry groups, and we have built precious professional networks over the years.

INDIA

- Companies Act 2013 mandates robust risk management with specific roles for Board, Audit Committee, and Independent Directors.

- RBI requires designated financial institutions to appoint an independent Chief Risk Officer for top-notch risk management.

- Listing Regulations require one-third independent directors for non-promoter chaired listed entities.

- Female directors are mandatory for certain companies and top 1,000 listed entities by market capitalization. Audit committe es for listed companies require at least three directors with a majority being independent.

UAE

- Regulations mandate well-resourced compliance and internal audit functions to assess legislation and risk management.

- Banks must establish independent, well-resourced Risk Management Functions led by a Chief Risk Officer reporting to the Board.

- ESG reporting and risk management are growing areas of focus.

SINGAPORE

- Robust ERM frameworks encouraged by MAS and ABS questionnaire for environmental risks.

- Applicable to high-risk sectors.

- Focus on sustainability in risk assessment.

HONG KONG

- HKMA guidance aligns with international standards.

- 12-month compliance period for institutions.

- Corporate Governance Bill enhances standards and Government promotes green finance.