A single fraudulent transaction can slip through the cracks in seconds, but its impact can ripple across an entire financial institution. The consequences? Regulatory penalties, reputational damage, and significant financial losses. That’s the stark reality of today’s digital banking landscape.

The rapid expansion of digital banking and fintech has made financial services more accessible. With just a few taps, people can open accounts, transfer money, and apply for loans. However, this same convenience has fueled a surge in cyber threats and fraud. In India alone, financial fraud amounted to a staggering INR 21,367 crores in 2023-2024.

Regulatory authorities are tightening compliance requirements, leaving banks under increasing pressure. They must sift through massive amounts of transaction data while complying with anti-money laundering (AML) rules, fraud detection protocols, and Know Your Customer (KYC) guidelines. Yet, many still rely on traditional methods, manual audits and rule-based systems, that struggle to keep up with the speed and complexity of modern financial crimes.

Harnessing AI for Data-driven Compliance and Real-Time Monitoring of Risks

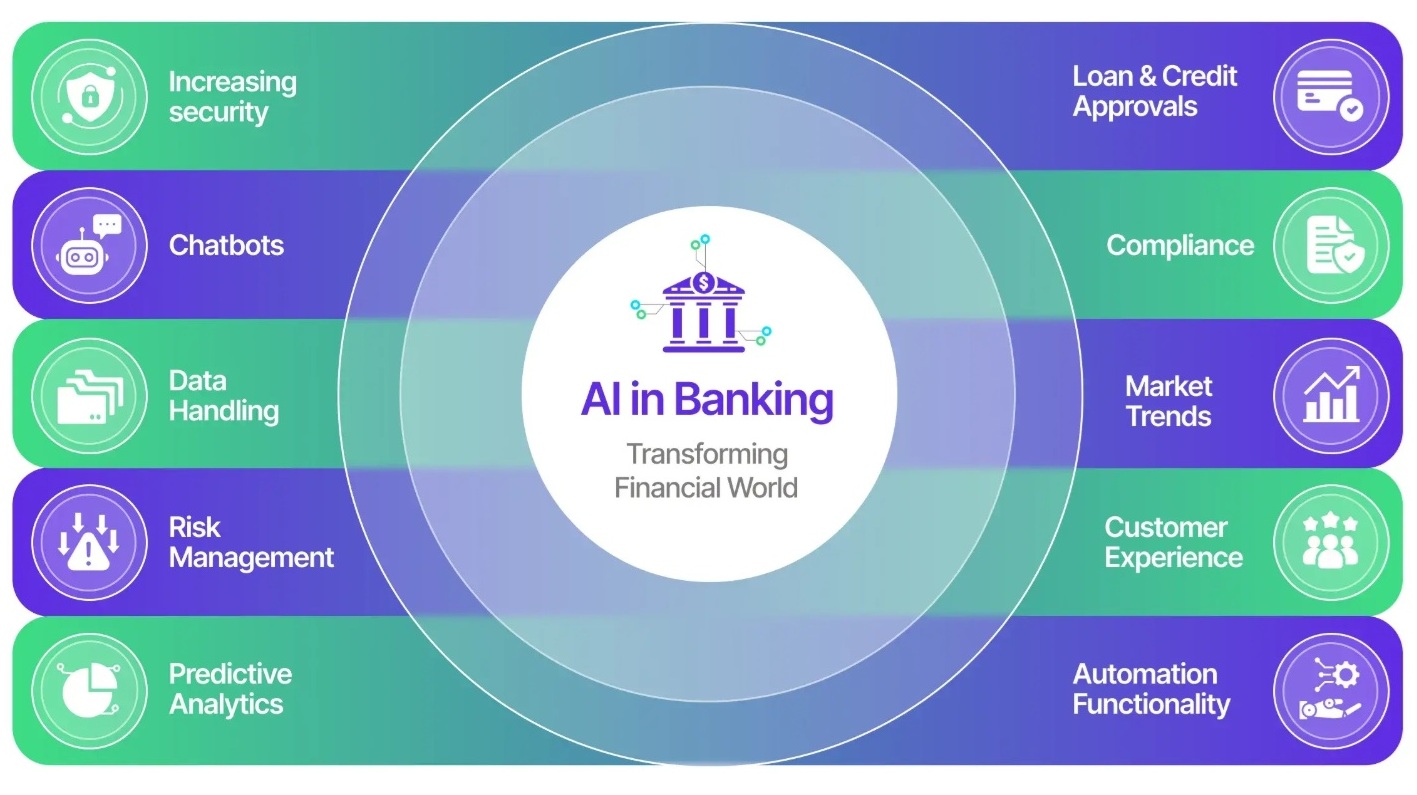

AI and smart data management are transforming compliance and risk management in banking. Manual monitoring of risk is no longer feasible as financial transactions traverse several channels such as digital wallets and real-time settlement systems. As a result, banks are implementing AI-powered fraud detectors including biometric authentication, behavioural analytics, and anomaly detection. Machine learning and AI-powered compliance frameworks enable real-time monitoring, identifying suspicious activities and unusual spending patterns. Even regulators are using AI to oversee all banking transactions.

Traditional and generative AI further enhance fraud detection by distinguishing between legitimate transactions and potential financial crimes. However, one of the significant challenges banks face is the increasing number of false positives, i.e. transactions incorrectly flagged as suspicious. High false positive rates create unnecessary roadblocks for customers and compliance teams with excessive manual reviews. To solve this, AI models trained on historical fraud patterns are being deployed to refine detection accuracy while reducing false alarms. Machine learning algorithms evaluate multiple risk factors, such as transaction frequency, spending location, and device fingerprints, to determine whether an activity is genuinely suspicious or just an unusual but valid transaction.

Private sector banks in India, which accounted for over 67 percent of reported fraud cases in 2024, have begun integrating AI-powered fraud detection solutions. Moreover, by combining predictive analytics with automation, banks can proactively mitigate risks, ensuring greater security for customers and regulatory compliance.

Enhancing regulatory reporting with AI

Regulatory reporting is one of the most tangled aspects of compliance management. Financial institutions must generate precise, timely reports on risk exposure, AML compliance, and suspicious activity. As regulations evolve, adapting reporting mechanisms swiftly is key to avoiding penalties. Generative AI algorithms can process vast financial data to generate risk assessment reports that are standardised, transparent, and easily auditable, and aligned to the changing compliance requirements. Beyond meeting compliance requirements, AI-driven reporting encourages a more proactive approach to regulation. Banks can spot potential compliance gaps before they escalate into serious problems, allowing them to act quickly to address these issues.

Strengthening Compliance Against Evolving Threats

As financial fraud becomes more complex, regulators tighten compliance laws. The Prevention of Money Laundering Act (PMLA) is the primary legislation governing AML compliance in India, requiring banks to enforce strong monitoring. AI-driven technologies now automate due diligence, transaction screening, and risk assessments to ensure compliance.

For enhanced security, banks are increasingly adopting biometric verification methods, including facial recognition and voice authentication. Generative AI has also brought new risks, such as deepfake-based identity fraud, compelling financial institutions to develop AI models that can identify synthetic fraud attempts by studying high-dimensional biometric data, including micro-expressions and tonal changes.

Cybersecurity remains another pressing concern. Financial institutions must address these challenges by investing in resilient AI frameworks that align with legal and ethical boundaries.

The Future of Data-Driven Compliance in India

AI is transforming risk and compliance in India’s financial sector. With fraud schemes becoming more sophisticated and regulatory requirements growing more complex, financial institutions need smarter data management solutions. AI-powered analytics, real-time monitoring, and automated reporting are reshaping the way banks detect, assess, and mitigate risks.

India’s digital public infrastructure (DPI) offers a solid foundation for expanding AI applications, although success hinges on collaboration between regulatory bodies, financial institutions, and technology providers. Public-private partnerships will drive innovation and ensure the implementation of responsible and effective AI integration. AI-powered compliance will be key to securing India’s banking ecosystem, helping institutions stay ahead of threats, build trust, and maintain financial stability while ensuring security and efficiency in a digital world.

Source: CXO today, March 19th 2025

Author: Hemant Tiwari, Managing Director and Vice President of India and SAARC Region, Hitachi Vantara